Commercial loan amortization period

Choose The CRE Mortgage that Fits Your Business Needs. This is the period of time it takes to pay off the loan if regular payments are made and assuming no interest only periods are inputted.

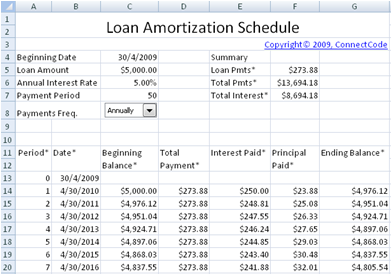

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

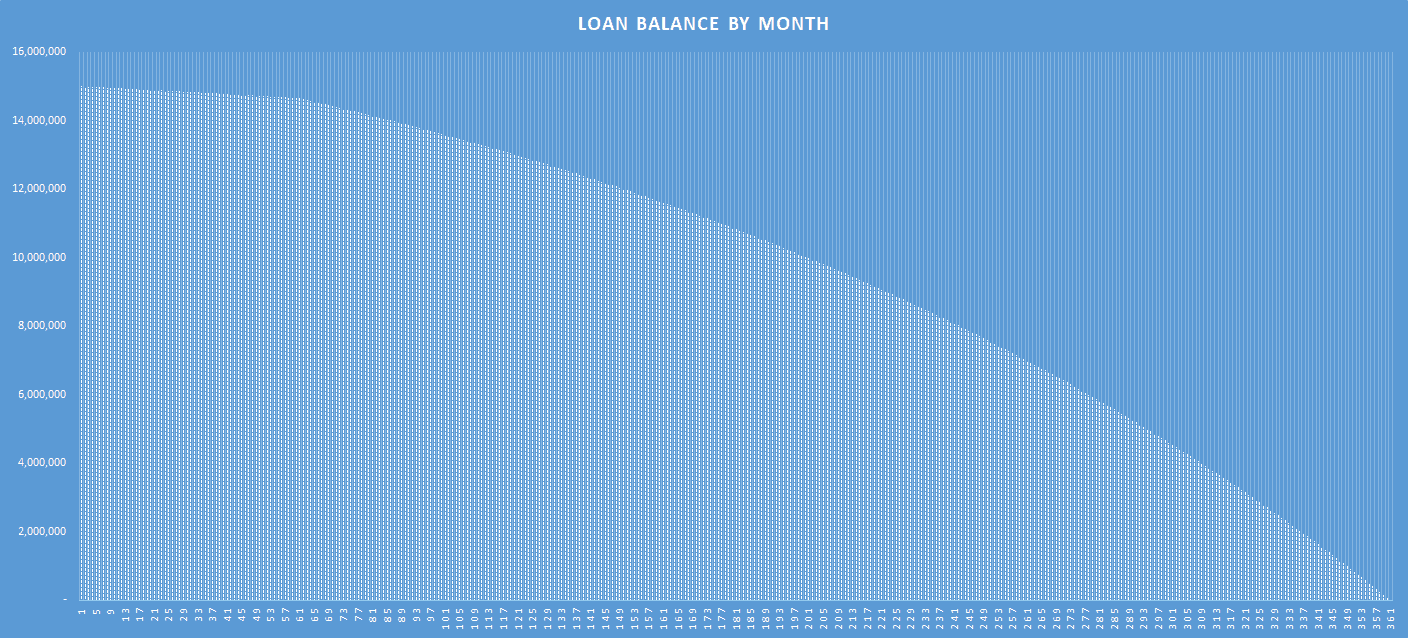

An amortization period refers to the total amount of time that a company uses before a loan a mortgage or a debt is repaid in full.

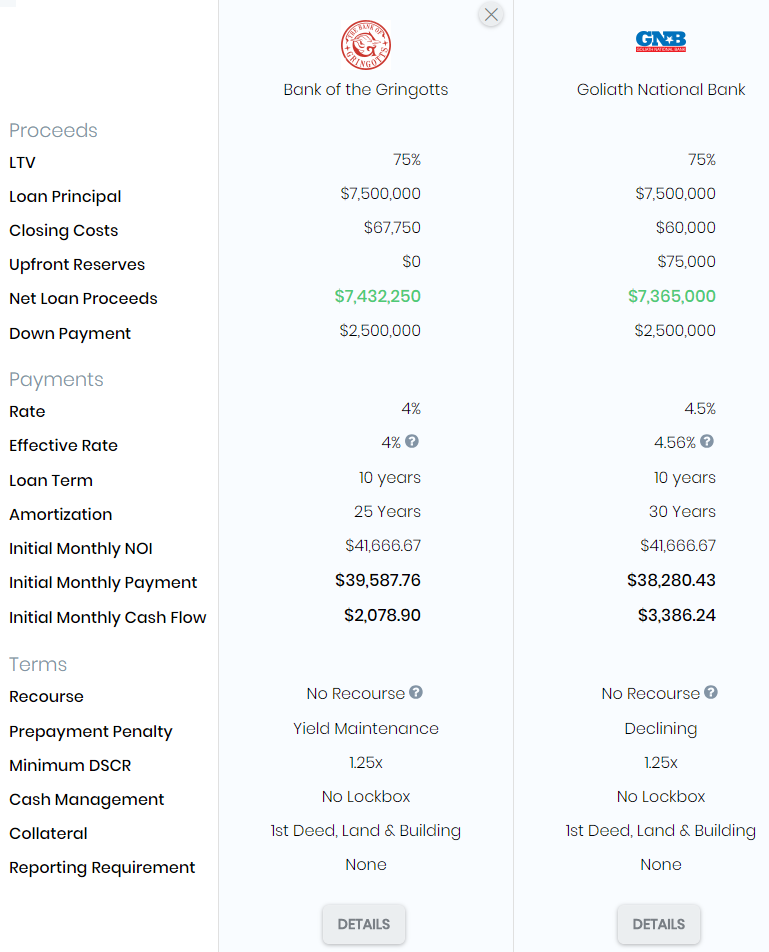

. Amortization period with periodic principal and interest. Compare Find The Best CRE Loan for Your Business. Interest rates vary drastically depending on risk.

The loan is scheduled to be paid off in equal annual. An example of split amortization would be a loan with a 5. Short or Long Term.

The commercial loan definition excludes loans secured by a vehicle manufactured for personal family and household use. What Are Split Amortizations. This is a good place to start.

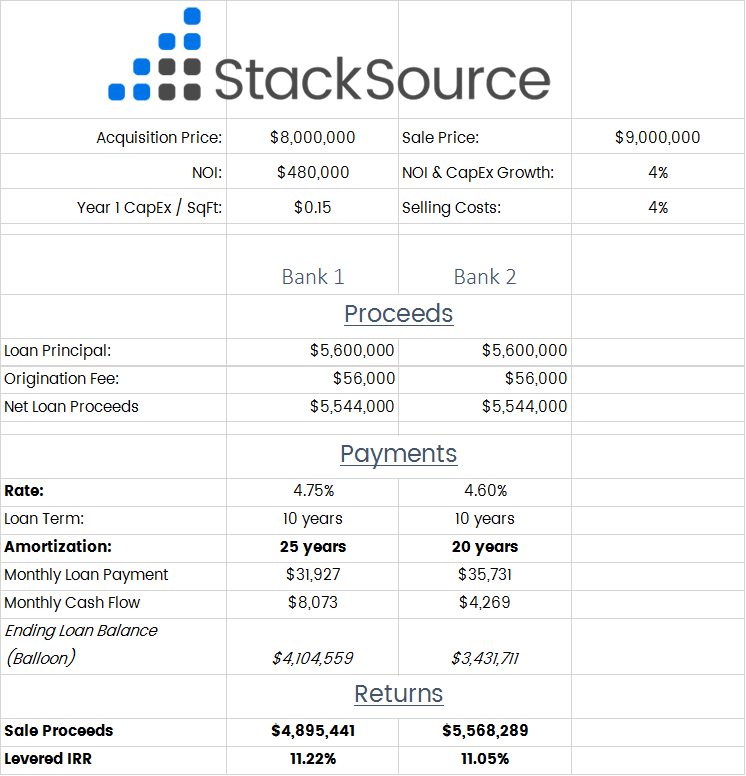

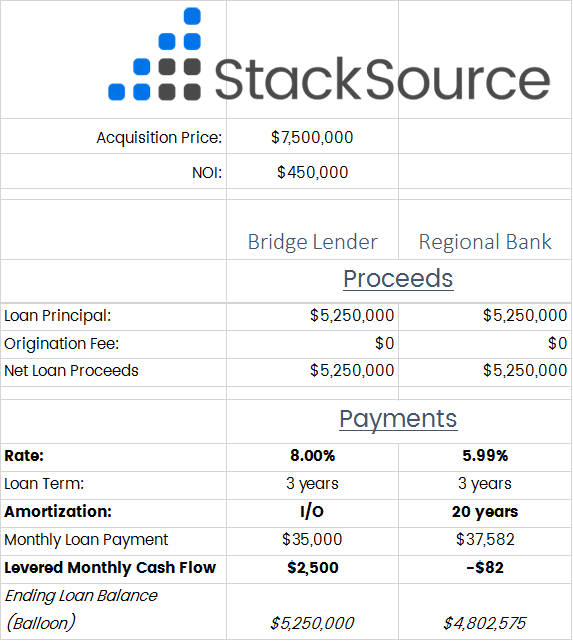

Finally depending on your arrangement with a lender there are instances where commercial mortgages may still adhere to a fully amortized payment schedule with longer 20. While residential mortgages typically have a 15 or 30-year. In commercial lending thats usually not the case.

Ad Helping with Islamic Loans Financial Solutions. Helping with Islamic Loans Financial Solutions No Riba Financing Methods. Amortization years The duration of most Commercial real estate mortgages varies from five years or less to 20 years and the amortization period is often longer than the term of the.

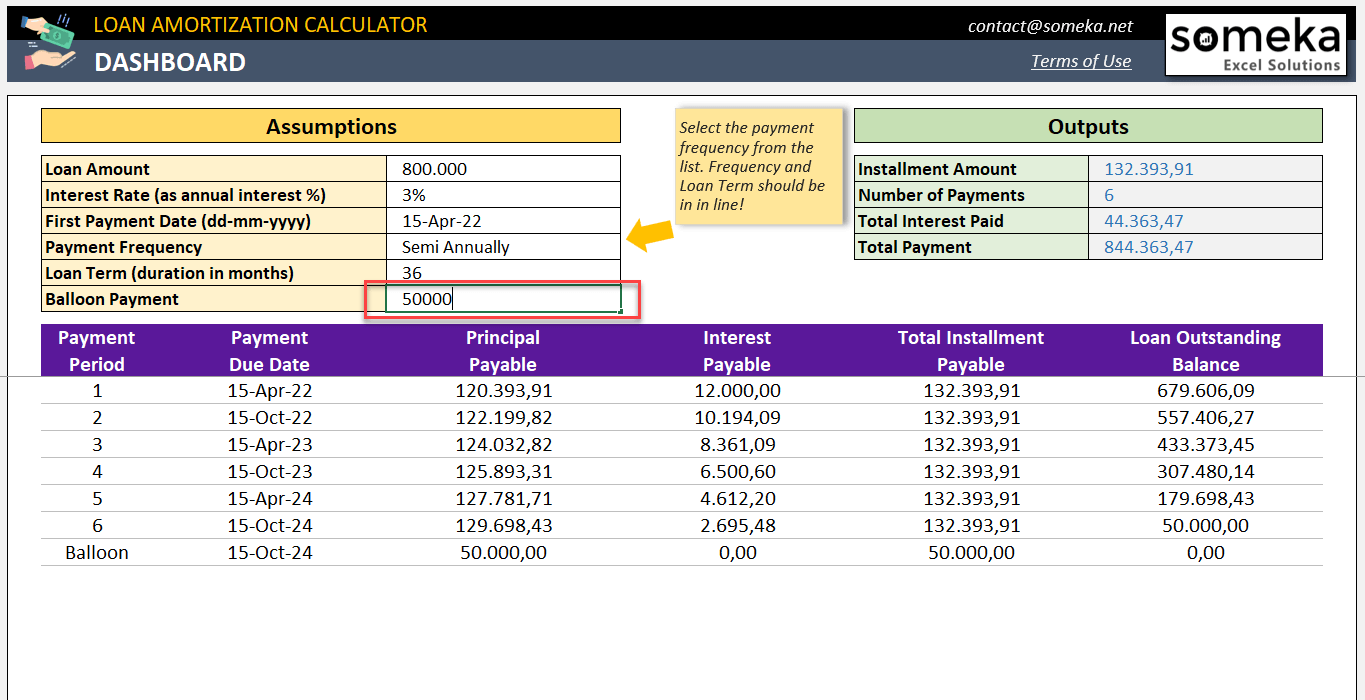

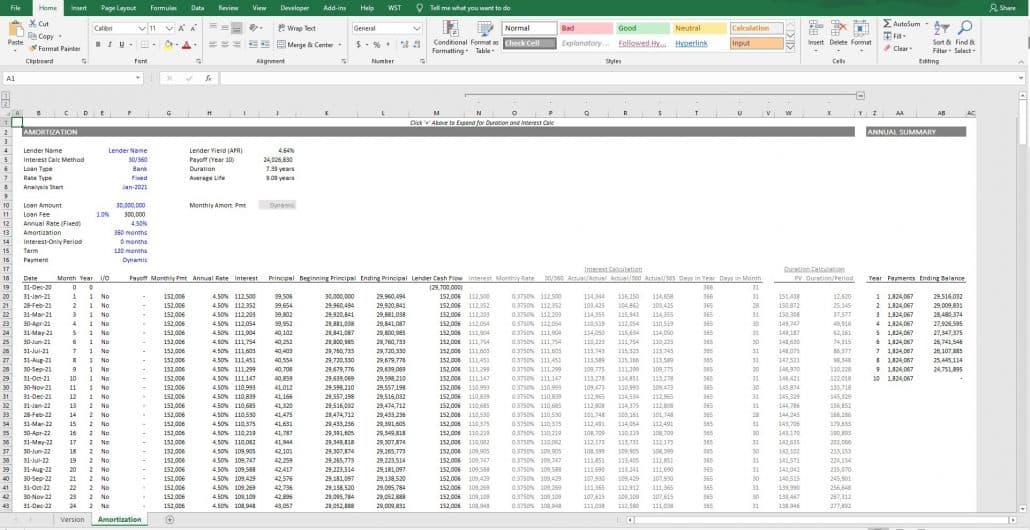

362 rows 800-687-0797 M-F 9am-7pm EST Apartment Loans Commercial Loans Rates Specials Apply Home Commercial Loan Calculators Amortization Schedule Amortization. Generally speaking amortization is the process of paying back a loan in installments over a period of time. Most multifamily loans are 30-year amortizations while core commercial loans are 25-year amortizations.

Input the amortization period in years. Typically a commercial real estate loan amortization period is between 20-30 years. Similar to a loans term an amortization period varies drastically from one transaction to the next.

Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25. Commercial mortgage amortization period Monday September 12 2022 Typically commercial mortgage loans have an amortization period between 10 20 years or 120 240. You can determine the loan amortization period on a basis needed to.

When the amortization period of the loan is longer than the payment term there is a loan balance left at maturity sometimes. Below is an amortization schedule for a business loan of 20000 at a 9 stated or nominal interest rate with a five-year term. Ad Conventional SBA or Bridge Loan.

An amortization period vary from one.

Time Value Of Money Board Of Equalization

Amortization Schedule Overview Example Methods

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog

Loan Amortization Calculator Excel Template Payment Schedule

Loan Amortization Calculator Excel Template Payment Schedule

9 Loan Amortization Schedule Template 7 Free Excel Pdf Documents Download Free Premium Templates

Typical Structure Of A Commercial Mortgage Term Sheet By Tim Milazzo Stacksource Blog

The Advanced Mortgage Amortization Module Updated Jul 2022 Adventures In Cre

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

Adding An Interest Only Period To An Amortization Schedule 1 Of 2 Youtube

Free Interest Only Loan Calculator For Excel

Watch Me Build A Mortgage Amortization Table In Excel

Loan Amortization Schedule With Variable Interest Rate In Excel

5 Things You Need To Know About Amortization Schedules

Free Loan Amortization Schedule

Simple Interest Loan Calculator How It Works