Frs investment plan calculator

Your first year benefit is based on a fixed formula and is determined by your age years of service the average of your highest 5 or 8. The contribution rates are currently at 6 for regular.

Effective Interest Rate Formula Calculator With Excel Template

This assumes annual retirement expenses of 68205 which is 90 of your last years income of.

. Use this calculator to see if your investment plan is on track to meet your investment goals - and receive suggestions on how to change it if you are falling short. Find A One-Stop Option That Fits Your Investment Strategy. The Investment Plan is funded through defined employer contribution rates based upon your salary and your FRS membership class.

Get Started In Your Future. Here you will find all the answer to the most common questions about the Florida Retirement. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

With Merrill Explore 7 Priorities That May Matter Most To You. Here is how the FRS describes it. The Investment Calculator can be used to calculate a specific parameter for an investment plan.

The FRS Investment Plan is a defined contribution plan in which employer and employee contributions are defined by law but your ultimate benefit depends in part on the. Ad Open an account in about 10 minutes. Searching for Financial Security.

Self Directed Investment Plan Option. Ad The RIA Model Can Help You Take Control Of Your Financial Future. The formula that the FRS uses to calculate is.

With Merrill Explore 7 Priorities That May Matter Most To You. If you are a member of the Florida Retirement System FRS Pension Plan you can access your personal retirement account information including service history. For regular risk teachers admin etc.

Our Financial Advisors Offer a Wealth of Knowledge. The FRS Investment Plan is a defined contribution plan in which employer and employee contributions are defined by law but your ultimate benefit depends in part on the performance. 75 of your average highest 5 paid years.

Ad What Are Your Priorities. Ad What Are Your Priorities. You decide how to invest your account.

Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. The average final compensation AFC used in calculating. The FRS Investment plan has a higher risk and a potential higher reward.

Use this calculator to see if your investment plan is on track to meet your investment goals - and receive suggestions on how to change it if you are falling short. Ad Ensure Your Investments Align with Your Goals. œ v 2lÂÀêù½MíîËéËMÜHm2 Þªð ao2åDˆšq9 7Ü9óûv 6 bávÂl xÒWÉ ƒ õÀ WËqÓÚœêÙØßmwìAÄÙÊÍºÍ CrÜ t0 L8äjʼw-bCÛ1Á Ù AlÔ-wÏnÅy4.

In the FRS Investment Plan you and your employer make a monthly contribution for your retirement based on your salary and membership class. 48 of your average 8. The Self-Directed Brokerage Account SDBA allows you to invest in thousands of different investment options in.

For most high risk employees police officer firefighters etc the pension will be. Divide your annual pension amount by the. Welcome to FRS Online.

FRS Pension Plan Normal Retirement FRS Investment Plan. For example to calculate the return rate. Your plan provides 624048 when you retire.

Online Security Tips Global Market Concerns Legislation Annual Fee Disclosure Statement Schedule an Appointment with an EY Financial Planner Make Your. Even a small difference in the fees you pay on your investments can add up over time. We have compiled the best e-book to maximize FRS and its completely FREE.

Vesting for FRS Pension Plan benefit eligibility will be after the completion of 8 years of creditable service. Under the Bank Plan you earn benefits for your retirement based on your eligible pay and years of creditable service. A good calculation when deciding whether to receive the pension or the Lump-Sum is comparing them to each other using the following formula.

We Pledge To Deliver Service Support To Meet The Unique Needs of Advisors We Serve. Retirement savings runs out at age 86. Find a Dedicated Financial Advisor Now.

Use this calculator to see how different fees can impact your investment. The tabs represent the desired parameter to be found. Ad Start Planning Your Financial Future With Our Digital Retirement Coach.

Years Of Service 16Average Final Compensation.

Hdb Valuation How Do I Figure Out How Much An Hdb Flat Is Worth Home Buying Process Premium Calculator The Borrowers

Real Estate Agent Infographic Example 10 First Time Buyer Mistakes Home Buying Buying First Home Buying Your First Home

Fidelity Retirement Calculator Review

![]()

Retirement Calculator Estimated Savings Fund Planner Bee

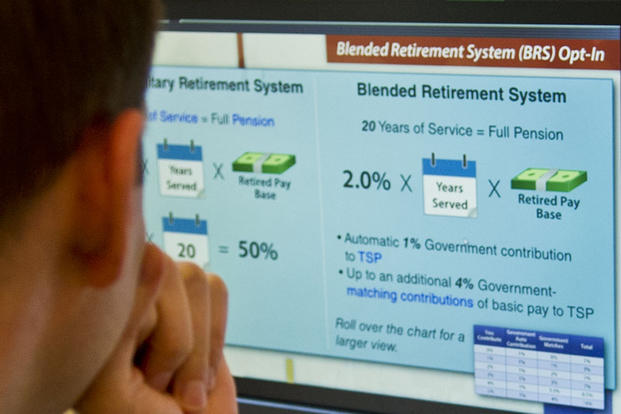

The Blended Retirement System Explained Military Com

Accounting Audit Banking Calculation Calculator Purple Business Logo Template Place For Tagline Stock Vector Image Art Alamy

Cfa Level 2 Fra Partial Goodwill And Full Goodwill Method Youtube

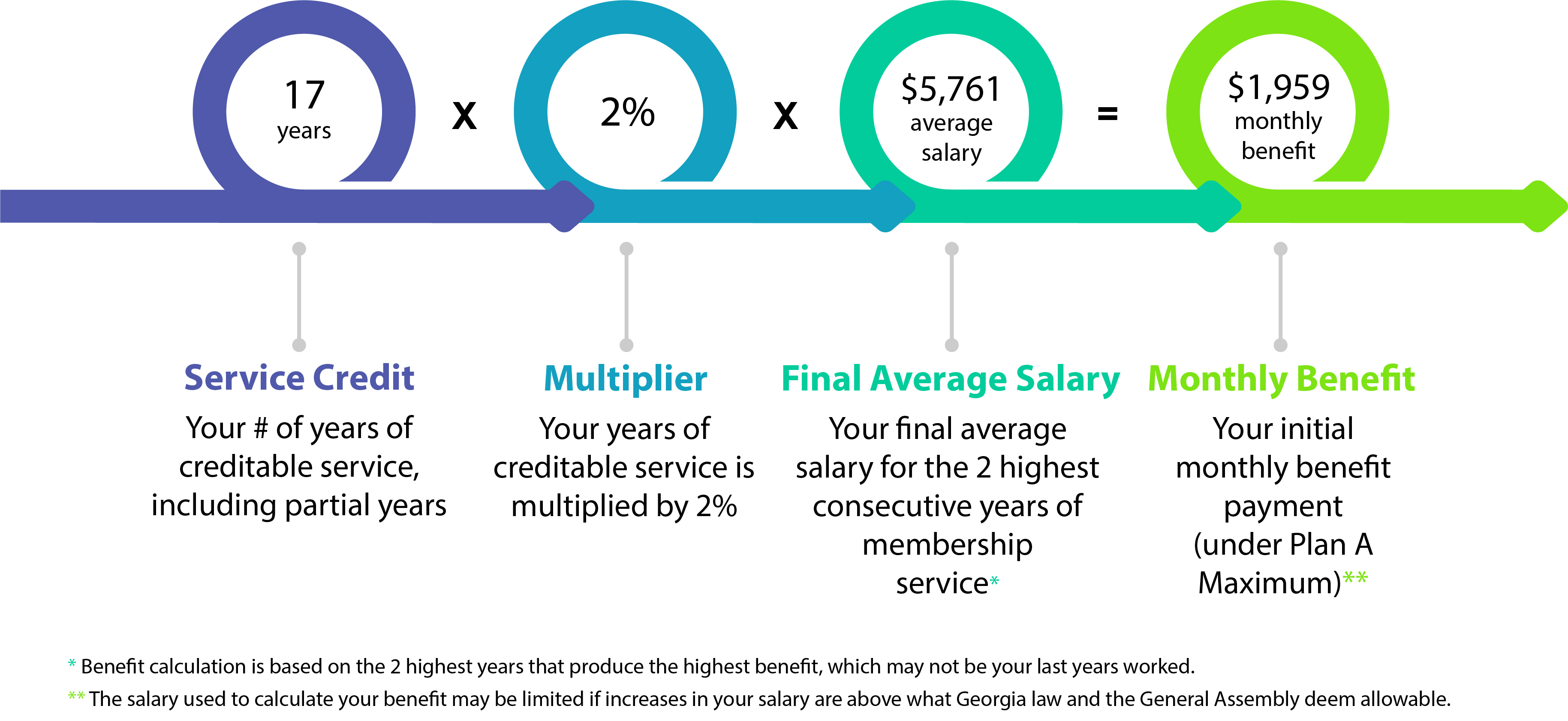

Teachers Retirement System Of Georgia Trsga

Cost Savings Calculator And Project Roi Calculator

508 Roi Calculator Illustrations Clip Art Istock

Planning For Retirement Using The Dave Ramsey Investment Calculator Dave Ramsey Investing Dave Ramsey Investing

Calculators Ipers

Rule Of 72 Calculator Rule Of 72 Student Finance Rules

Cost Savings Calculator And Project Roi Calculator

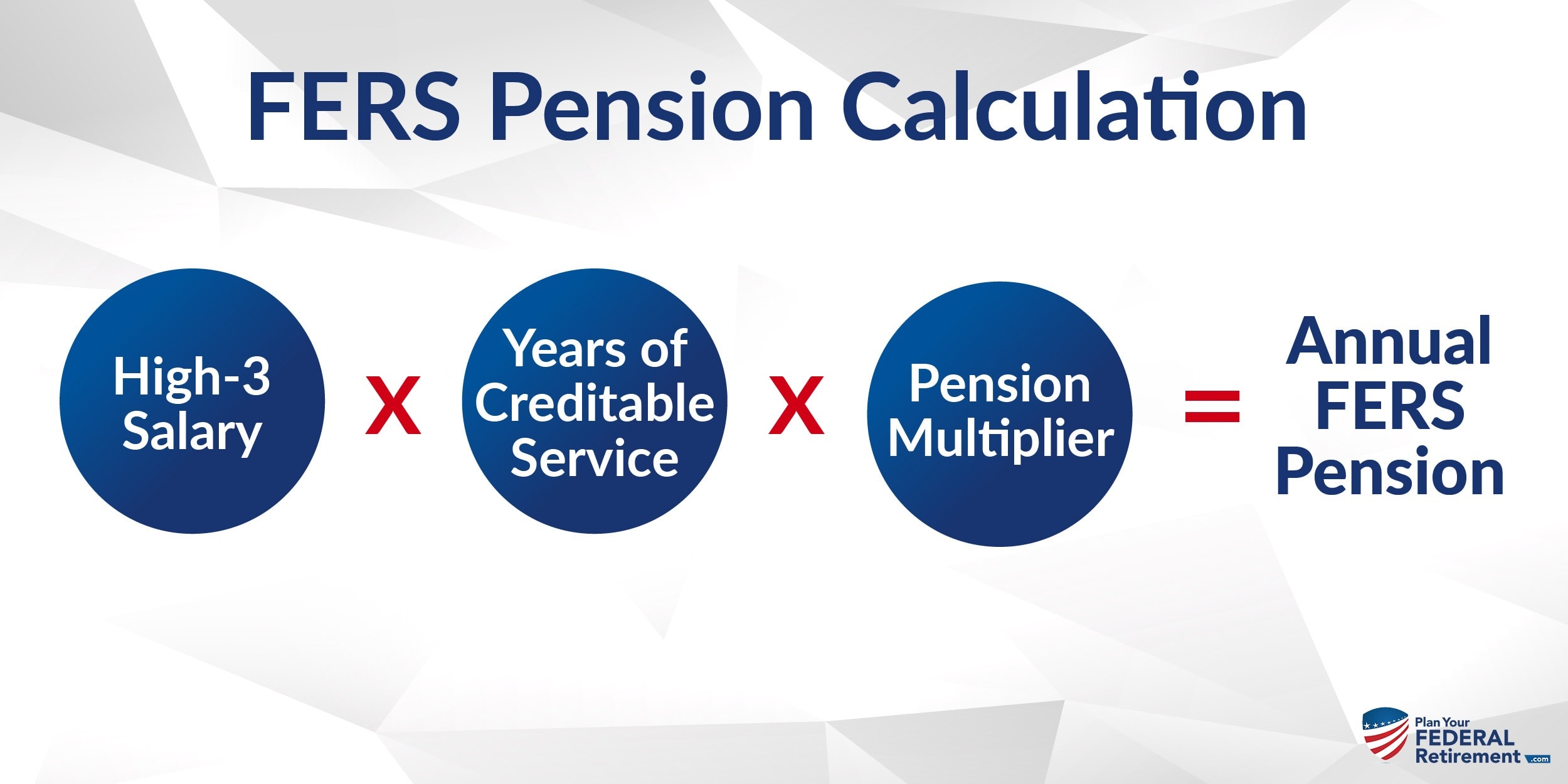

Understanding Your Fers Retirement Plan Your Federal Retirement

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

2